This blog post is the second article of a 4-part series entitled Beyond Stakeholder Mapping, which aims to explore the engagement dynamics and specificities each quadrant requires in the stakeholder mapping journey.

You can access the other articles here: Part 1 | Part 3 | Part 4, or download the guide with all articles here:

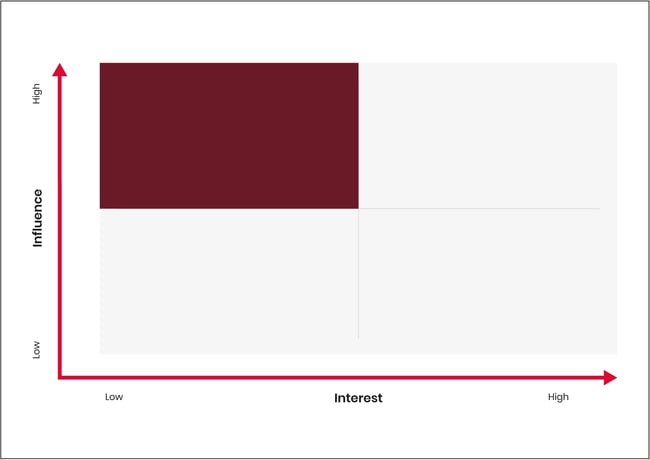

Disinterested yet high-influencer stakeholders: the high-influence/low-interest quadrant

Your stakeholder mapping frequently identifies a motley selection of High-influence/Low-interest individuals and organisations, and it is often something of a puzzle working out how best to handle them.

The first thing to note is that it is much easier to assess the influence axis. They represent forces that matter – big employers, municipal leaders, local personalities and of course the media.

Geographically, open the local newspaper or browse its social media site. Who seems to have clout? Whose stories seem to get the most prominence? Which organisations appear lots of time?

However, many issues are not location-specific. If we take an industry like railways, there will be supplier stakeholders who make the trains or develop the technology. There will also be local authorities responsible for integrated transport planning, academic and practitioner planners, trade unions and passenger voice bodies.

They all have a measure of influence but are often specialists. Unless the subject matter of the forthcoming decision or programme is precisely within the scope of their priorities, they will remain silent, like brooding giants waiting to see if something changes.

And they often do! The key to managing those in this category is to appreciate the likelihood that their interest in a specific issue might change. Influence can take years to accrue; interest can change overnight.

So, in the example of the railways, consider the current issue of modernising ticketing.

The introduction of a new back-office system might be of relatively limited interest to those influential stakeholders. But, as happened recently, when the issue morphs into a proposal to close ticket offices, it means that trade unions and representative passenger bodies would immediately move rightwards on the stakeholder map – as their ‘interest’ in the subject is assessed to be higher.

Looking at a stakeholder map in a dynamic way – not just as a single moment in time, but on a timeline - can be critical.

Equally important is the ability to look at the relationship between the consultor body and stakeholders as a whole in a ‘steady state’ as well as on specific issues. Those who are in the High/Low category have the potential to move as the agenda changes.

The usual advice is to stay close to these stakeholders. Keep in touch; monitor their behaviour; understand their concerns; try to anticipate what is in their minds and is likely to arouse their interest. This is not always as easy to detect.

Take an organisation such as a local Chamber of Commerce – influential in many places. Like so many representative bodies, there may, inside it, be members with particular interests.

If the Local Authority is proposing changes to road usage, it might not be of overwhelming interest to 90% of the membership. But to half a dozen road hauliers, it might be of considerable importance, and they may be agitating for the Chamber to formulate a position on the issue. How would you assess it for Mapping purposes?

Some years ago, we developed a useful approach. We called it The Agenda Test. Imagine the organisation you are mapping were to hold a routine meeting this evening. Where would the issue feature on the agenda? Right at the top – suggesting that it was of great concern and of major interest to members? Or maybe further down? Or just under ‘Any Other business’. Maybe it won’t even appear at all!

Armed with this insight, it is possible to calibrate the degree of interest with some precision.

And for those stakeholders that appear not to have much of a stake in the subject matter, the best advice is to monitor what happens to their agendas.

There is no need to ‘spy’ on them. Most are only too delighted that there is a public interest in their activities. Far better to get to know one or two key individuals who are known to shape the organisation’s priorities and provide leadership.

The media, especially, needs constant vigilance. They are the classic source of influence, but only rarely do they have a genuine interest in a particular issue.

Their actual self-interest lies in selling papers, screen usage or advertising. A good old-fashioned row and human interest stories work well for them, as do populist campaigns – some of which are real but some of which are just synthetic, mock-indignation exercises in cynicism! Telling the difference is important – and affects how you place them on a stakeholder map.

Remember how much influence is now wielded by platforms such as Facebook with local community groups like “We Love Our Town”. If, however, there is little direct interest in the topic under consideration, they are firmly in the High/Low category.

For these stakeholders, the best policy, therefore, is one of continuous observation, so as to avoid being taken by surprise. For those with the greatest influence, there is a case for continuous engagement. And that is yet another story.

In the next article, we explore the Low Influence/High Interest category.

Download the Beyond Stakeholder Mapping Guide: